Expert FHA Loan Loan Options in Thousand Oaks, CA

Contact An Expert

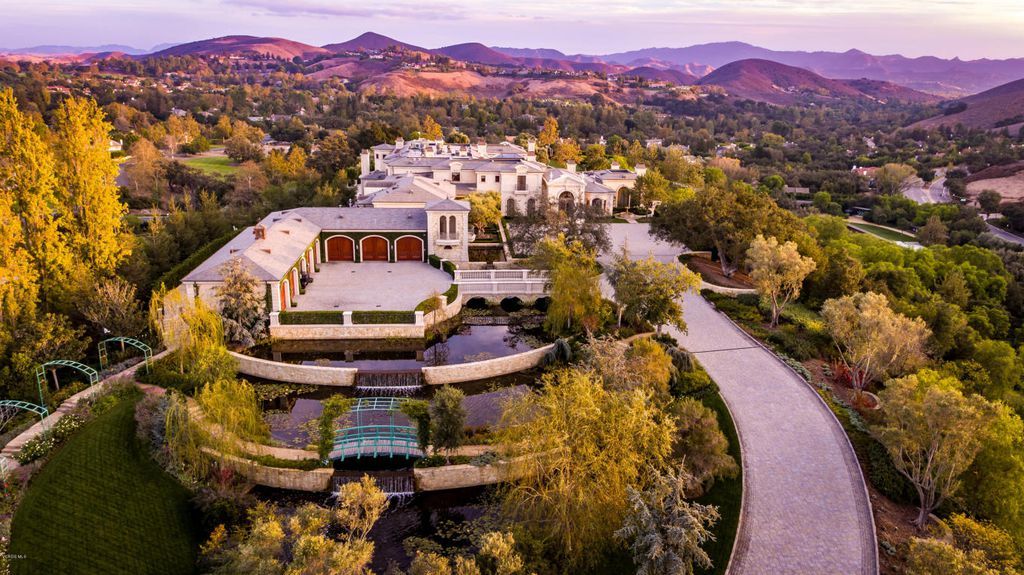

Thousand Oaks, located in the picturesque Conejo Valley, is famous for its secure neighborhoods, top-notch schools, and unparalleled standard of living. The city’s breathtaking natural scenery, diverse cultural offerings, and flourishing economy make it a highly desirable place for individuals aspiring to own a home. To turn this dream into a reality in Thousand Oaks, FHA loans provide a promising pathway, and Elite Financial is your trusted companion through the entire process of obtaining an FHA loan in Thousand Oaks, California. Let us help you out.

Thousand Oaks: A City That Feels Like Home

Thousand Oaks stands as a jewel in the heart of California, providing a blend of suburban tranquility, natural beauty, and urban amenities. The city offers a high quality of life with a mix of leisure, educational, and career opportunities.

- Natural Wonders of Thousand Oaks

Framed by majestic mountain ranges, Thousand Oaks is characterized by its beautiful open spaces and breathtaking natural landscapes. With over 150 miles of multi-use trails, the city is a haven for outdoor enthusiasts. It’s also home to the Gardens of the World, a remarkable public garden that displays diverse flora from across the globe.

- Vibrant Cultural Scene

Thousand Oaks boasts a vibrant cultural scene, with institutions like the Thousand Oaks Civic Arts Plaza bringing top-class performances to the community. The city also hosts numerous festivals and events throughout the year, contributing to its lively social calendar.

- Thriving Economy and Job Opportunities

Thousand Oaks is a dynamic economic hub, housing several major corporations and offering ample job opportunities across sectors such as biotechnology, healthcare, and finance.

Living in Thousand Oaks: A Blend of Suburban Comfort & Urban Amenities

With its high livability standards, diverse neighborhoods, and excellent amenities, Thousand Oaks presents an appealing prospect for those considering homeownership.

- Great Neighborhoods

Thousand Oaks is home to a range of neighborhoods, each with its unique charm. From the upscale residences of North Ranch to the peaceful community vibes of Newbury Park, the city caters to a variety of lifestyle preferences.

- Quality Education

The city is proud of its strong educational system, which includes highly rated schools and prestigious higher education institutions like California Lutheran University.

- Robust Economy

Thousand Oaks’ robust economy, driven by diverse industries, provides abundant career opportunities, making it an attractive location for both professionals and families.

Thousand Oaks Real Estate: The Dream of Homeownership

The real estate market in Thousand Oaks is as diverse as the city itself, offering a variety of housing options to suit different budgets and lifestyles. Homeownership in Thousand Oaks is about more than just buying a property; it’s about being part of a thriving community and enjoying the excellent quality of life that the city has to offer.

The Role of FHA Loans in Thousand Oaks Homeownership

Securing homeownership in Thousand Oaks, CA is now possible with the help of an FHA loan. An FHA Loan is a government-backed mortgage loan insured by the Federal Housing Administration, designed to help low-to-moderate-income borrowers achieve their dream of owning a home.

Elite Financial: Your Trusted FHA Loan Provider in Thousand Oaks

When considering an FHA loan in Thousand Oaks, CA, it’s crucial to choose a reliable and experienced loan provider. Elite Financial has been serving the Thousand Oaks community for years, offering flexible and accessible FHA loan solutions tailored to the specific needs of each client.

The Benefits of FHA Loans in Thousand Oaks With Elite Financial

When you get FHA loans through our professional mortgage brokers, you enjoy the following benefits:

- Small Down Payment

Elite Financial offers FHA loans in Thousand Oaks with exceptional benefits. Ideal for first-time buyers, our FHA loans require a down payment as little as 0.5%, making homeownership more accessible. If you haven’t owned a home in the past three years and meet certain income restrictions based on family size, you might qualify for our loan programs that come with either a 3% down payment grant, which doesn’t need to be repaid, or a 3% silent second. Please note that these funds are subject to budgetary restrictions of the State of California.

- Credit-Friendly FHA Loans

We understand that past credit issues should not dictate your future. Our FHA loans offer a number of benefits for those who have faced credit issues in the past. Our programs require a minimum FICO score of 580 or possibly no FICO score. There are also FHA loan programs that require a minimum FICO score of 550 with a 10% down payment.

- Assumable FHA Loans

One of the significant advantages of our FHA loan in Thousand Oaks, California is that they are assumable. That means when you decide to sell your property, the buyer can assume your loan. In this type of financing agreement, the outstanding mortgage and its terms can be transferred from you to the buyer, helping them avoid the need to obtain their own mortgage. This can be particularly beneficial in times of high interest rates, as having a low fixed rate assumable loan would be attractive to a prospective buyer and potentially increase the selling price of your property.

- Refinance With Very Limited Documents & No Income

A significant advantage of FHA loans in Thousand Oaks, CA is the ability to refinance with very limited documentation. If interest rates drop, you can refinance your loan with no income or asset documentation or appraisal if you have made regular on-time mortgage payments for the past 12 months and continue to use the property as your primary residence. Most importantly, refinancing an FHA loan requires no out-of-pocket money, and nothing needs to be added to the loan balance. However, remember that loan limits vary based on county income statistics.

How Do FHA Loans Work?

FHA loans are backed by the government, which gives borrowers access to better interest rates. To provide lenders a guarantee in case of loan default, the FHA charges borrowers a mortgage insurance premium of 1.75% of the loan upfront and a monthly fee collected with each payment.

FHA Loan Qualifications

Qualifying for an FHA loan is straightforward. The government backing results in lower qualifying guidelines for borrowers, as well as low closing costs and down payments.

- Essential Criteria

To qualify for FHA loan in Thousand Oaks, CA with Elite Financial, the eligibility criteria includes the following:

- Typically, borrowers are required to have a minimum FICO score of 580.

- The down payment option allows for as little as 3.5% of the purchase price.

- Gift funds can be used to cover the entire amount of the closing costs and down payment.

Once you meet the minimum credit and financial requirements, the Elite Financial team will provide you with the best terms and financing options.

Frequently Asked Questions

The answers to the following questions will help you understand FHA loans better:

An FHA loan, backed by the Federal Housing Administration, allows borrowers to obtain a mortgage with lower down payments and credit requirements than traditional loans. It’s particularly beneficial for first-time homebuyers and those with past credit issues.

Thousand Oaks offers an excellent quality of life, with a robust economy, high-quality education, and stunning natural beauty. An FHA loan can make homeownership in this thriving city more attainable.

Yes, one of the advantages of FHA loans is its flexibility towards those with past credit issues. If you have had problems in the past but have been working to rebuild your credit, you may still qualify for an FHA loan. Elite Financial is ready to guide you through this process and help you understand the credit requirements.

Yes, you can use an FHA loan to refinance your current mortgage. This process is relatively straightforward, especially if you are refinancing from another FHA loan.

Get Your FHA Loan in Thousand Oaks, CA Via Elite Financial NOW!

With Elite Financial, securing an FHA loan in Thousand Oaks, CA has never been easier. Our team of dedicated professionals will guide you through the process, answering all of your questions along the way. We aim to make the process of purchasing a home as seamless as possible for our clients, and we work tirelessly to ensure you get the best terms available.

So, why wait? To learn more about how you can get your FHA loan in Thousand Oaks, CA through the professional mortgage brokers at Elite Financial, Reach us Out!

Frequently

Asked Questions

Lorem ipsum dolor sit amet, consectetur adipisi cing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat. Lorem ipsum dolor sit amet, consectetur adipisi cing elit, sed do eiusmod.

In as little as 10 calendar days! Make your offer stand out by offering to close quickly. Lean on us to make it happen.

Our Reviews

What People Say

Jaxson Philips

“Mike Kagan and Elite Financial have been helping my clients for over 20 years get the best financing and service. We have come to rely on their honesty, commitment to service, and customer care to earn repeat referrals. We highly recommend them to anyone purchasing or refinancing.”

Jesse H.

“Thank you so much for helping finance the purchase of our home. Our family is so excited to be in our new home and we couldn’t be more thankful for how easy you made the process. We have heard such horror stories from friends trying to get a loan, that we feel lucky we found you because you made the transaction so painless while answering all our (endless) questions and explaining the process every step of the way. Thank you all!!”

Damian L.

“Mike Kagan has the expertise and integrity necessary in this business to provide the dedicated service that you, (we) deserve.

Speak or Text with Our Team Today

Stay Connected With Us

Blog & News

Is a Free Refinance Possible? Yes!

There is no word in the English Language that carries more emotional baggage than “Free.” We are introduced to… There is no word in the

Is Refinancing Worth It?

Have you been seeing and hearing ads to refinance your mortgage? Wondering if a no-cost refinance is too good… Have you been seeing and hearing

The Home Purchase Process

Step 1 – Get preapproved for a mortgage and determine what payment you are comfortable with. Most experienced Real… Step 1 – Get preapproved for