Your Home with a Reverse Mortgage in Thousand Oaks, CA

Home » Reverse Mortgage » Reverse Mortgage in Thousand Oaks

Contact An Expert

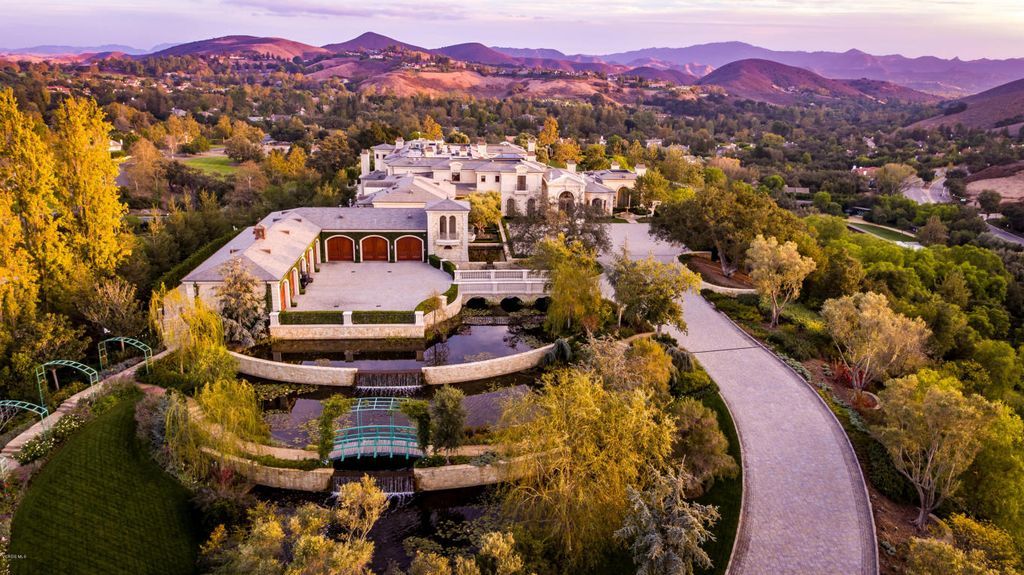

The Beauty of Thousand Oaks

Thousand Oaks takes its name from the numerous, glorious oak trees that grace its streets, parks, and neighborhoods. The city offers a unique blend of suburban tranquility and urban amenities, all while being surrounded by breathtaking natural beauty.

- The Natural Wonders

From the scenic Santa Monica Mountains to the lush Los Robles Trails & Open Space, Thousand Oaks is home to numerous parks and nature reserves. These natural spaces serve as recreational hotspots and preserve the local ecosystem, housing many species of plants and animals native to Southern California.

- Warm Weather

The climate in Thousand Oaks is one of its most attractive features. With more than 270 sunny days a year, the city experiences mild winters and warm, dry summers – ideal weather for outdoor enthusiasts and those who appreciate a temperate climate.

- Rich Cultural Experiences

Thousand Oaks is rich in cultural heritage. It hosts various festivals, events, and performances at venues like the Thousand Oaks Civic Arts Plaza. Moreover, the city houses several museums and historic sites, offering an immersive experience of its vibrant culture and history.

Thriving Economy and Lifestyle in Thousand Oaks

Thousand Oaks boasts a strong economy, high standard of living, and diverse community, making it a desirable place for people from all walks of life. It offers you:

- A Thriving Business Environment

The economy of Thousand Oaks is robust and diverse, with thriving sectors like healthcare, biotechnology, education, and retail. The city is home to numerous businesses, providing a wealth of job opportunities and economic growth.

- Quality of Life in Thousand Oaks

Residents of Thousand Oaks enjoy a high quality of life, with excellent healthcare facilities, top-rated schools, and a low crime rate. The city’s community-centered initiatives and events create a vibrant, engaged community.

- Education in Thousand Oaks

Thousand Oaks is home to many highly-rated public and private schools. It also hosts several colleges, including the California Lutheran University, offering quality higher education.

Real Estate and Homeownership in Thousand Oaks

Thousand Oaks real estate is diverse, featuring an array of properties from luxury estates in gated communities to cozy single-family homes. As a homeowner in Thousand Oaks, you get to be part of a thriving community and enjoy the city’s lifestyle, economy, and natural beauty.

- The Benefits of Homeownership

Owning a home in Thousand Oaks offers stability and financial benefits like building equity and potential tax advantages. Homeownership allows you to put down roots in a thriving community and enjoy the lifestyle that Thousand Oaks offers.

- The Importance of Making The Right Financial Decisions

Making the right financial decisions is crucial when it comes to homeownership. One such choice that many homeowners in Thousand Oaks consider is opting for a reverse mortgage.

Reverse Mortgage in Thousand Oaks, CA

A reverse mortgage is a loan product that allows homeowners aged 62 and above to convert a part of their home equity into cash, while continuing to live in and own their home.

Why Choose Elite Financial As Your Mortgage Broker?

Elite Financial has been assisting homeowners in Thousand Oaks for years, providing reverse mortgage solutions that cater to each client’s unique needs. We offer you:

- Our Expertise in Reverse Mortgages

The Elite Financial team has profound knowledge of the Thousand Oaks real estate market and an in-depth understanding of the intricacies of reverse mortgages. With our experience and skills, we can assist you in navigating the reverse mortgage process smoothly and confidently. We are committed to helping you unlock the potential of your home equity.

- Diverse Reverse Mortgage Options

We provide a variety of reverse mortgage options to suit different financial situations and objectives. Our team will guide you through each option, ensuring you make the most informed decision.

- Smooth and Efficient Reverse Mortgage Process

We recognize that the reverse mortgage process can seem intimidating. That’s why we have simplified our application and approval procedures. Our team guides you each step of the way, providing clear information, addressing your concerns, and ensuring a seamless journey.

Secure Your Financial Future in Thousand Oaks with Elite Financial

With the city’s thriving economy, lively community, and beautiful natural landscapes, Thousand Oaks is a place like no other. Partnering with Elite Financial can help you secure your financial future in this vibrant city.

Explore Your Reverse Mortgage Options Today

If you are considering a reverse mortgage in Thousand Oaks, contact Elite Financial today. Our team of loan experts is ready to help you explore your options and guide you on your path to financial security. We are passionate about helping our clients achieve their financial goals.

Frequently Asked Questions

A reverse mortgage is a loan available to homeowners aged 62 or older, allowing them to convert part of the equity in their homes into cash. This product is designed to help seniors with limited income.

A reverse mortgage can offer financial stability and flexibility, especially for seniors with limited income. With a robust housing market and high home values, Thousand Oaks can provide substantial equity for homeowners to tap into.

Reverse mortgages come in three types: single-purpose reverse mortgages, proprietary reverse mortgages, and Home Equity Conversion Mortgages (HECMs). Each type has different features and benefits. Elite Financial can help you understand which one is best for you.

To qualify for a reverse mortgage, you must be at least 62 years old, own your home outright or have a low mortgage balance, and live in the home as your primary residence.

You continue to own your home and live in it. However, you must continue to pay for maintenance, taxes, and insurance. The loan becomes due when you sell the home, permanently move out, or pass away.

To start the process with Elite Financial, reach our team out through our website or by contacting us directly. We will guide you through the application process and provide assistance.

Apply For Reverse Mortgage in Thousand Oaks Via Elite Financial NOW!

Thousand Oaks offers a blend of rich lifestyle opportunities and financial prospects. With a diverse housing market, strong economy, and a welcoming community, this city is a dream for homeowners. As your trusted partner for reverse mortgage in Thousand Oaks, Elite Financial is prepared to help you harness the financial potential of your home. Experience the unique benefits that Thousand Oaks has to offer. Start your journey towards enhanced financial security with us NOW!

Frequently

Asked Questions

Lorem ipsum dolor sit amet, consectetur adipisi cing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat. Lorem ipsum dolor sit amet, consectetur adipisi cing elit, sed do eiusmod.

In as little as 10 calendar days! Make your offer stand out by offering to close quickly. Lean on us to make it happen.

Our Reviews

What People Say

Jaxson Philips

“Mike Kagan and Elite Financial have been helping my clients for over 20 years get the best financing and service. We have come to rely on their honesty, commitment to service, and customer care to earn repeat referrals. We highly recommend them to anyone purchasing or refinancing.”

Jesse H.

“Thank you so much for helping finance the purchase of our home. Our family is so excited to be in our new home and we couldn’t be more thankful for how easy you made the process. We have heard such horror stories from friends trying to get a loan, that we feel lucky we found you because you made the transaction so painless while answering all our (endless) questions and explaining the process every step of the way. Thank you all!!”

Damian L.

“Mike Kagan has the expertise and integrity necessary in this business to provide the dedicated service that you, (we) deserve.

Speak or Text with Our Team Today

Stay Connected With Us

Blog & News

Is a Free Refinance Possible? Yes!

There is no word in the English Language that carries more emotional baggage than “Free.” We are introduced to… There is no word in the

Is Refinancing Worth It?

Have you been seeing and hearing ads to refinance your mortgage? Wondering if a no-cost refinance is too good… Have you been seeing and hearing

The Home Purchase Process

Step 1 – Get preapproved for a mortgage and determine what payment you are comfortable with. Most experienced Real… Step 1 – Get preapproved for